Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

September, 2017 - Week 2 Edition

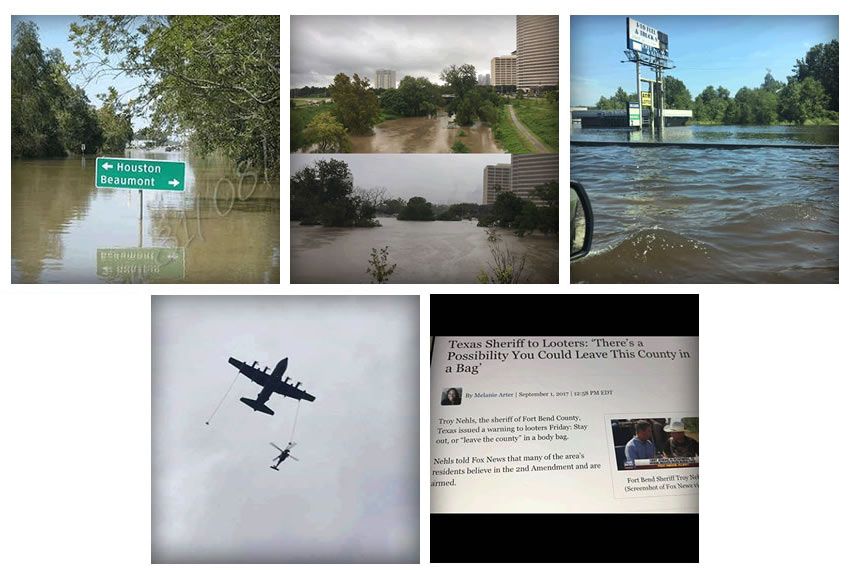

Private, Volunteer Help is Often the Best – Especially in Texas!The national news media is showing non-stop pictures of the devastation in Texas – and now Florida – while often ignoring some inspiring stories of volunteer relief efforts, mostly by private-sector volunteers, with most of those being people of faith – from church and religious community groups of all varieties. We also applaud the on-duty and off-duty law enforcement and other first responders. They are true heroes. Sometimes it irks me that the NFL and other TV outlets urge everyone to donate to the American Red Cross (ARC), through the ease of texting $10 or more on your phone, when the ARC has been shown to be somewhat ineffective in past crises (see the August 28 Slate article: “The Red Cross Won’t Save Houston.”) We are based in Beaumont, Texas, a region of particularly high flooding in recent weeks. Most of our staff was able to work most days, but I am particularly proud of the volunteerism of many of our staff, rushing to help neighbors and disadvantaged communities recover from the flood waters. They provided boat rescues, food, water, shelter, blankets and other necessities. In my hometown of Lake Charles, LA, the Red Cross reportedly resisted free gourmet meals provided by local restaurants and other local volunteer services because the Red Cross couldn’t “vet” them, but they couldn’t stop the volunteer Cajun Navy in Texas from rescuing people and the Cajun Gravy (with their legendary great cooking) from cooking for first responders. While looting in our area has been minimal, that may be because looters are in danger of being shot on sight, and much of Texas is armed and believes in the Second Amendment! According to a local area police chief, “there is a place in hell (without ice) for those who loot in these dangerous times.” Back in 2005, after Hurricanes Katrina in Louisiana and Rita in Texas, the local volunteers in New Orleans and Texas did some of the best rescue work. America has a great tradition of volunteerism – church relief programs, volunteer first responders, meal delivery through Meals on Wheels – and the list could go on forever – so we need to thank and empower our religious and humanitarian entities while improving large government and mega-charity bureaucracies!

Gold is in a “Stealth Bull Market” in 2017Gold reached its highest level in over a year last Friday, surpassing $1,351 before retreating to $1,347 over the weekend, completing its third straight week of gains. Gold has staged a spectacular two-month recovery. Gold’s mid-year low was $1,207 on July 10, but as of September 10 gold is up $140 per ounce (+11.6%) in two months. Silver is up a greater percentage recently, from $15 in early July to $18 last week (+20%). Year-to-date, gold is up 17%, while silver and the U.S. stock market are up about 10%. In previous editions, we have written that gold is the “star of the commodity universe,” but that story has been ignored by the press, perhaps because gold’s increases have been so slow, steady and even stealthy. Gold’s rise this year has been slow and consistent with very little volatility. We began the year at $1,150 but then gold’s price quickly ascended to $1,200 by January 31. Gold closed over $1,200 every day (but one) from January 31 to August 26. Gold “knocked on the door” of $1,300 several times but it couldn’t seem to break that “unlucky” number 13. Then, it soared well above $1,300 on August 29 and has stayed above $1,300 ever since. Through September 10, gold is up 17% so far in 2017 in a stealth bull market. Gold’s sudden rise above $1,300 was precipitated by the rising threat of a nuclear showdown in North Korea, but those rumors of war will inevitably rise and fall. What has kept gold high is a weak dollar, caused in part by the fact that the Federal Reserve is not expected to raise short-term interest rates at their next meeting of the Federal Open Market Committee (FOMC) next week (September 19-20). The Fed won’t raise short-term rates while long-term interest rates are falling so sharply – to 2.03% last week. Is $1,400 Gold Coming Soon?The last time gold reached $1,400 was in 2013, so a return to those levels would be a newsworthy event. Many mainstream investment firms are joining the gold bandwagon and expecting $1,400 by year’s end. Phil Streible, senior marketing strategist at Chicago’s RJO Futures, sees $1,400 gold. Last Thursday on CNBC, he said: “The flight to quality as a result of North Korea's [self-claimed] detonation of a hydrogen bomb has caused investors to flee riskier assets and go into your safe haven asset like the gold market.” Streible also said that the devastation of the two Hurricanes, Harvey and Irma, “will handcuff the Federal Reserve from having the ability to raise interest rates for the remainder of the year. Because of that, we'll see interest rates sell off, and gold, since it's a non-yielding asset, will most likely continue higher from there.” Given all these circumstances, he said, “it seems obvious that gold is on a path to move higher.” Jeb Handwerger, editor of GoldStockTrades, said “All of the ingredients to break $1,400 are there—our debt is out of control and our deficit could skyrocket, especially with infrastructure plus military spending” in addition to a possible confrontation with North Korea. “We could be maybe weeks away from that $1,400 breakout, which could signal a new uptrend in gold not seen in many years,” he said.

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |