Media Appearances

- New York Times

- The Wall Street Journal

- New York Times

- USA Today

- Bloomberg TV

- NRA News

- AMAC.us (Money Columnist)

- MoneyNews.com

(Insider Columnist) - Forbes

- NASDAQ

- NBC News

- CNBC

- Fox Business Network

- CBS Moneywatch

- SmartMoney (Personal Finance Magazine of Wall Street Journal)

- Kiplinger's

- Newsmax

What Others Are Saying

Ed Reiter, Executive Director,

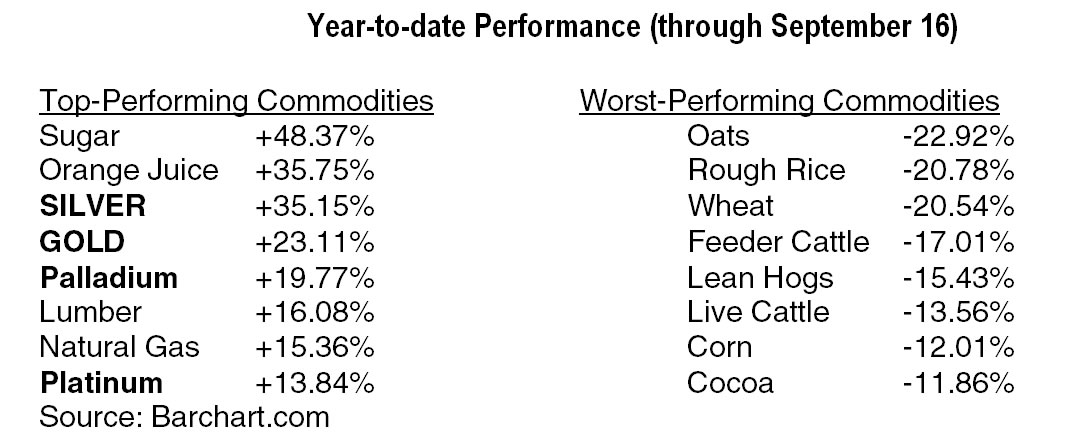

September 2016 – Week 3 EditionSilver Rises in 2016Silver has quietly out-performed gold and the other precious metals – and most other commodities – so far in 2016. Here is a table outlining the eight most (and least) profitable commodities so far in 2016:

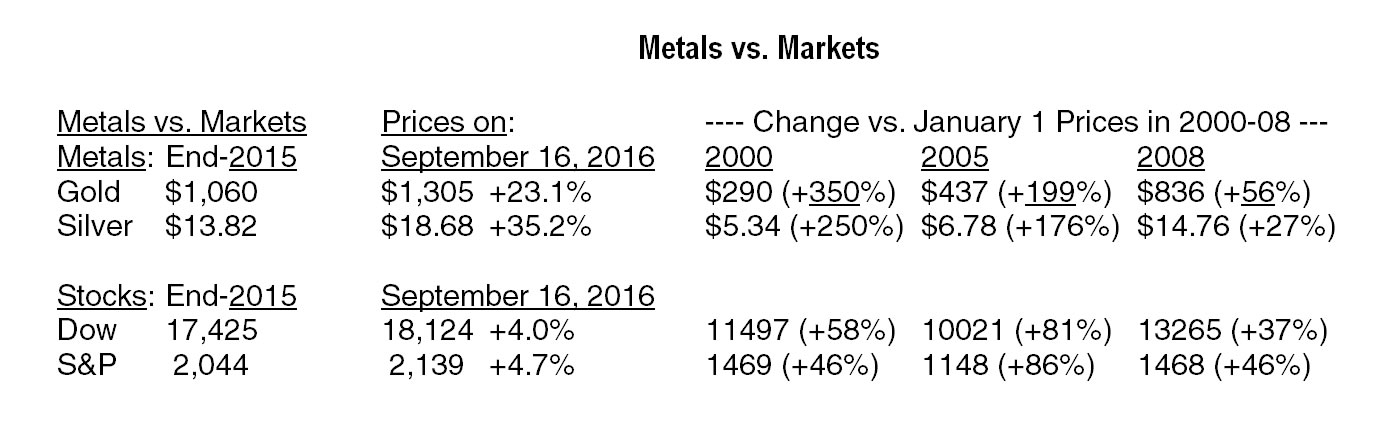

Silver rose 50% in the first seven months of 2016, rising from $13.82 at the end of 2015 to a peak of $20.71 on August 2. Silver traded over $20 for most of July and August but has since dipped below $19. Silver tends to vacillate in much wider swings than gold due to its smaller market volume (vs. gold). That means that any small increase in silver investment demand can generate large percentage gains in silver. Gold Closes Down For The WeekGold closed down for the week, along with most other commodities, due in most part to a surge in the U.S. dollar. Crude oil prices fell to $43. The rest of the commodity universe – including grains, meats, industrials and soft commodities – are also at or near the low end of their recent trading ranges. Nearly all commodities are universally quoted in U.S. dollar terms, so when the dollar rallies, commodities tend to fall. However, the Wall Street Journal’s U.S. dollar index is still down slightly (-3.37%) year-to-date. Due to sub-par U.S. economic growth, the Federal Reserve is NOT expected to raise rates this week (on Wednesday). The possibility of a rate hike, as calculated by the fed-fund futures market, dropped to 20% last Friday, down from 30% at the same time a week earlier. We’ll know the Fed’s decision soon, as the Federal Open Market Committee (FOMC), convenes eight times a year, this time on September 21-22. One Final Comment…Last week, I recommended a column by Peggy Noonan on the heroes of 9/11. This week, she has done it again in her weekend column in the Wall Street Journal, “Travel Back to an Early Clinton Scandal,” about the Travelgate firings in 1993, when Hillary and Bill were in their first few tumultuous months in the White House. Similar scandals have followed Hillary for almost 25 years now. I am no fan of some of Trump’s antics either. I wish the disappointing Libertarians had a podium at the debates, but they have been shut out once again. Over the next few weeks, we will be exploring what a new controversial President could mean for gold and silver prices. I welcome your predictions. Email me at This email address is being protected from spambots. You need JavaScript enabled to view it..

Metals Market Report Archive >Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher. |